ILKS – The Hedging Forex-Auto Trading Robot

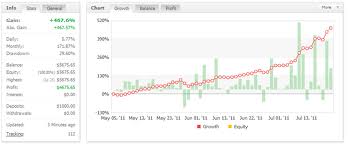

- This Robot has a lot of potential and profitability. Use only one pair at a time. Be Cautious on Lot Component and you are good to go.

- The work principle and algorithm of the ILKS 1.6 Dynamic expert advisor

- The ILKS expert advisor is based on a simple trading system based on two standard technical indicators – the RSI (Relative Strength Index) and CCI (Commodity Channel Index).

- The first one gives you the direction for opening a position and the second one limits losses. A selling situation forms if the closing price of the previous candlestick is below that of the one before it, and the RSI values are above RsiMinimum (the oversold area).

- A signal to buy appears when the closing price of the candlestick preceding the actual one is higher than that of the candlestick before it, and the RSI values are under the RsiMaximum (the overbought area). If the price goes against us, the robot opens additional orders at lower levels and waits for a movement in the direction of the trades: upwards for buying and downwards for selling.

- By increasing the volume of the next orders the expert advisor nears the breakeven level and tries to close the whole series of orders with a profit.

- Most beginner traders come to this algorithm sooner or later. As long as this strategy belongs to “risk-safe” ones, we may get an almost perfect profitability chart and an exorbitant profit at tests if we set up all parameters right. However, practice is very different from testing. Parameters and settings of ILKS 1.6 Dynamic Platform: chiefly MetaTrader 4, MT5 versions also exist

- Currency pairs: any, but GBP/USD and EURO/USD is a priority

- Timeframe: any, but the developer recommends M5.

- Profitability may change depending on the timeframe. Working hours: 24h.

- The peculiarity of ILKS 1.6 Dynamic is that the range of the researched trend period changes dynamically depending on market volatility.

- LotExponent is the multiplication factor for the lot size in a series of trades (a series is over when its general position closes with a profit, after which a new series begins). The lot is calculated based on the initial trade volume – the parameter called Lots. Each next order in the series is calculated as the trade size multiplied by the LotExponent factor.

- DynamicPips switches on dynamic changing of the distance between the trades. If this parameter is “true”, ILKS decides independently where to place the next order (based on the DEL parameter). If it is “false”, the distance between the trades will always equal DefaultPips. This function makes the expert advisor flexible.

- DefaultPips is the distance between trades in points. The smaller it is, the more often will trades open. A larger value of the parameter helps withstand long trends. And vice versa, a smaller value helps make a larger profit in flats.

- Glubina is the number of candlesticks for analyzing volatility. The expert advisor calculates how many points the price has passed during a certain number of candlesticks (the difference between the high and low of the price in the chosen period) and divides the values received by DEL. The minimal distance is limited by DefaultPips divided by DEL and the maximal – by DefaultPips multiplied by DEL. DEL works only if DynamicPips is on. It changes the initially set step in DefaultPips.

- Slip is the largest possible slippage in points. Lots are the size of a lot of the first trade in a series. This is the main trading lot to which the expert advisor returns each time a series closes with a profit. Setting the initial size of the lot, estimate the potential aggregate volume of subsequent trades.

- if your lot size is 0.01, Lotdecimal must be 2. When Lots is 0.5, Lotdecimal is 1. TakeProfit is the number of points needed for closing the series of trades; i.e., the series closes when the profit reached the TakeProfit value. This parameter should not be too large because the main aim of the expert advisor is to close the series with a profit as quickly as possible and start a new one. Drop closes positions automatically if the quotations leap. For the analysis, the CCI on M15 with the calculation period of 55 bars is used. To switch this function off, set an extremely high value, such as 10,000.

- RsiMinimum is the value of the lower border of the RSI (the oversold area) for opening selling trades. RsiMaximum is the value of the upper border of the RSI (the overbought area) for opening buying trades.

- MagicNumber is the unique number of expert advisors. It helps distinguish between the trades opened by different advisors.

- MaxTrades is the maximal number of trades opened simultaneously. Set the maximal size of a series of orders based on your starting capital. UseEquityStop switches on the Stop Loss by equity.

- TotalEquityRisk: when the set percentage of a drawdown by equity is reached, all trades close automatically.

- UseTrailngStop enables Trailing Stop for all orders. By default, the value is 10 and incorporated in the code.

- UseTimeOut closes positions after a certain time. Regardless of the financial result, all positions close if they remain in the market longer than set by the parameter.

- MaxTradeOpenHours is the time in hours after which all positions close.

- Note:

Get this amazing Forex Trading EA Robot ABSOLUTELY FREE from us. Please open a trading account with our Suggested Brokers and use a Forex VPS from our Recommended VPS Providers to automate your trade without hassles. You can Download the Forex EA FREE from Here: CLICK

DISCLAIMER: Please read carefully before you decide to invest in Forex Market

- Forex Trading is dangerous and can result in a substantial loss of money. Due to the uncertain nature of the Forex market, there is no guarantee that our products will produce any favorable results. Before you purchase please read our RISK DISCLAIMER.

BEAR THIS IN MIND: The Forex market changes from day to day, and that past performance can therefore not be guaranteed to repeat in the future. Past performance shown and in videos may use aggressive trading approaches and risk management to prove the potential of the Forex robot over long periods. Because of this, we recommend that you test the EA on your own broker account using many variations of currencies, time frames, and settings to make sure you experience favorable results in current market conditions before trading live accounts. - Forex Trading EA/Robot is just a piece of Programming to Sophisticate your trading but never guarantee your winning.

- Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. No representation is being made that any account will or is likely to achieve profits or losses similar to those that may be shown.

- Past performance is not indicative of future results. Individual results vary and no representation is made that clients will or are likely to achieve profits or incur losses comparable to those that may be shown.

- Before deciding to trade products you should carefully consider your objectives, financial situation, needs, and level of experience. The possibility exists that you could sustain a loss of some or all of your deposited funds and therefore, you should not speculate with capital that you cannot afford to lose.